Pix and digital payments in Brazil

I came across this story via Benedict Evans' newsletter (it’s not the kind of thing I’d usually track). What I find interesting is this is a hugely successful rollout of a digital payments system done by a central bank. It’s helping real people, including those in poverty.

Meanwhile, crypto tokens are held by crypto bros and middle-class white guys like myself trying to make a quick buck. Just goes to show that innovation doesn’t always come from where you expect.

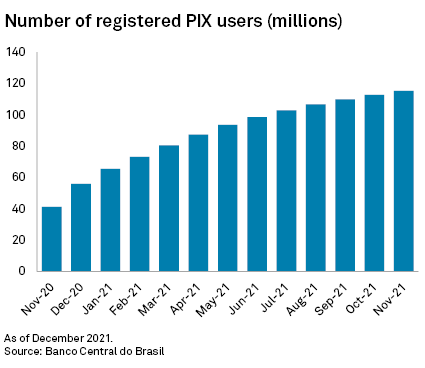

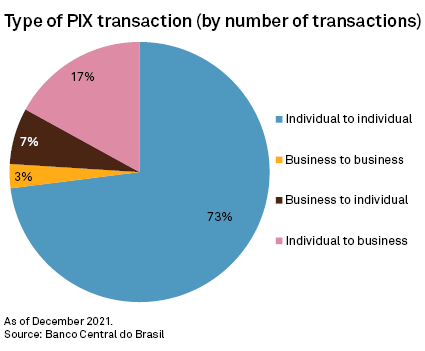

Source: Pix breaks ground in Brazil, shakes up payments market | S&P Global Market IntelligencePix, rolled out by the Banco Central do Brasil in Nov. 2020, was built for efficiency and financial inclusion. It now has 107.5 million registered accounts, more than half of the country’s population. One year after implementation, more than half a trillion Brazilian reais were transacted through the low-cost payments system last month. According to central bank data, Pix payments volume is already equivalent to 80% of debit and credit card transactions.

[…]

“Except for very particular transactions, market penetration tends to 99% on all individual transfers,” [Julian Colombo, CEO of banking technology firm N5] added. However, the rollout has not been without hiccups, including kidnapping.

[…]

On a recent Sunday in Rio de Janeiro, a three-member samba band played for a crowded restaurant. At the end, they passed around the tambourine to collect money. One diner apologized, saying he did not have any cash on him. The drummer said, “No problem, I take Pix,” and proceeded to share his code — which can be an email, phone number or other easy-to-remember code — with the diner, who promptly transferred the money his way.