- Payments: Mastercard, PayPal, PayU (Naspers’ fintech arm), Stripe, Visa

- Technology and marketplaces: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, MercadoPago, Spotify AB, Uber Technologies, Inc.

- Telecommunications: Iliad, Vodafone Group

Blockchain: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited - Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, UnionSquare Ventures

- Nonprofit and multilateral organizations, and academic institutions: Creative Destruction Lab, Kiva,Mercy Corps, Women’s World Banking

- Facebook's Libra could threaten the global financial system (Sky News) — "it's effectively reinvented PayPal, only with Facebook Pounds instead of regular ones."

- Why We’re Joining the Libra Association (Spotify) — "One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems."

- The real risk of Facebook’s Libra coin is crooked developers (TechCrunch) — "A shady developer could build a wallet that just cleans out a user’s account or funnels their coins to the wrong recipient, mines their purchase history for marketing data or uses them to launder money. Digital risks become a lot less abstract when real-world assets are at stake."

- Cleaner and more energy efficient

- More space efficient

- Safer

- Making the

worldcity a better place - Force for economic inclusion

- Micro-mobility revolution has just begun (Stuff) — "Lime Scooters, Onzo Bikes and the like may seem like novelties at the moment but will likely revolutionise urban transport within 20 years."

- Scooters and Second Order Consequences (Scooter Map Blog) — "Micro-mobility will augment the public transit backbone."

- The Right Way to Regulate Electric Scooters (CityLab) — "After all, if a bicycle needs to meet minimum standards for forks and frames, then an e-scooter ought to meet minimum similar requirements for floorboards and stems."

The habit of sardonic contemplation is the hardest habit of all to break

Angela Carter with the story of my life there. I can't help but be skeptical about 'Libra', Facebook's new crytocurrency project. I'm skeptical about almost all cryptocurrencies, to be honest.

The website is marketing. It's all about 'empowering' the 'unbanked' worldwide. However, let's dive into the white paper:

Members of the Libra Association will consist of geographically distributed and diverse businesses, nonprofit and multilateral organizations, and academic institutions. The initial group of organizations that will work together on finalizing the association’s charter and become “Founding Members” upon its completion are, by industry:

We hope to have approximately 100 members of the Libra Association by the target launch in the first half of 2020.

So, all the usual suspects. How will Facebook ensure that we don't see the crazy price volatility we've seen with other cryptocurrencies?

Libra is designed to be a stable digital cryptocurrency that will be fully backed by a reserve of real assets — the Libra Reserve — and supported by a competitive network of exchanges buying and selling Libra. That means anyone with Libra has a high degree of assurance they can convert their digital currency into local fiat currency based on an exchange rate, just like exchanging one currency for another when traveling. This approach is similar to how other currencies were introduced in the past: to help instill trust in a new currency and gain widespread adoption during its infancy, it was guaranteed that a country’s notes could be traded in for real assets, such as gold. Instead of backing Libra with gold, though, it will be backed by a collection of low-volatility assets, such as bank deposits and short-term government securities in currencies from stable and reputable central banks.

So it sounds like all of the value is being extracted by founding members. Now let's move onto the technology. Any surprises there? Nope.

Blockchains are described as either permissioned or permissionless in relation to the ability to participate as a validator node. In a “permissioned blockchain,” access is granted to run a validator node. In a “permissionless blockchain,” anyone who meets the technical requirements can run a validator node. In that sense, Libra will start as a permissioned blockchain.

This is as conservative as they come, which is exactly what your strategy would be if you're trying to transfer the entire monetary system to one that you control. People often joke about Facebook as 'social infrastructure', but this is a level beyond. This is Facebook as financial infrastructure.

Given both current and potential future regulatory oversight, Facebook are very careful to distance themselves from Libra. In fact, the website proudly states that, "The Libra Association is an independent, not-for-profit membership organization, headquartered in Geneva, Switzerland."

To be fair,Josh Constine, writing for TechCrunch, notes that Facebook only gets one vote as a founding member of the Libra Association. It does actually look like they're in it for the long-haul:

In cryptocurrencies, Facebook saw both a threat and an opportunity. They held the promise of disrupting how things are bought and sold by eliminating transaction fees common with credit cards. That comes dangerously close to Facebook’s ad business that influences what is bought and sold. If a competitor like Google or an upstart built a popular coin and could monitor the transactions, they’d learn what people buy and could muscle in on the billions spent on Facebook marketing. Meanwhile, the 1.7 billion people who lack a bank account might choose whoever offers them a financial services alternative as their online identity provider too. That’s another thing Facebook wants to be.

John Constine

Whereas before there's always been social pressure to have a Facebook account, now there could be pressures that span identity and economic necessities, too.

Some good commentary on the hurdles ahead comes from Kari Paul for The Guardian, who writes:

The company claims it will not attempt to bypass existing regulation but instead “innovate” on regulatory fronts. Libra will use the same verification and anti-fraud processes that banks and credit cards use and will implement automated systems to detect fraud, Facebook said in its launch. It also promised to give refunds to any users who are hacked or have Libra stolen from their digital wallets.

Kari Paul

Would this be the same kind of 'innovation' that Uber uses to muscle its way into cities without a license? Or to muscle its way into cities without a license? Perhaps it's the shady business practices beloved of PayPal? Both companies are founding members, after all!

Right now, developers can get access to a 'test network' for Libra. The system itself won't be running until the end of 2020, so there's a lot speculation. Here's some sources I found useful, but you'll need to make up your own mind. Is this a good thing?

Life is like riding a bicycle. To keep your balance, you must keep moving

Thanks to Einstein for today's quote-as-title. Having once again witnessed the joy of electric scooters in Lisbon recently, I thought I'd look at this trend of 'micromobility'.

Let's begin with Horace Dediu, who explains the term:

Simply, Micromobility promises to have the same effect on mobility as microcomputing had on computing. Bringing transportation to many more and allowing them to travel further and faster. I use the term micromobility precisely because of the connotation with computing and the expansion of consumption but also because it focuses on the vehicle rather than the service. The vehicle is small, the service is vast.

Horace Dediu

Micromobility covers mainly electric scooters and (e-)bikes, which can be found in many of the cities I've visited over the past year. Not in the UK, though, where riding electric scooters is technically illegal. Why? Because of a 183 year-old law, explains Jeff Parsons Metro:

You can’t ride scooters on the road, because the DVLA requires that electric vehicles be registered and taxed. And you can’t ride scooters on the pavement because of the 1835 Highways Act that prohibits anyone from riding a ‘carriage’ on the pavement.

Jeff Parsons

It's only a matter of time, though, before legislation is passed to remove this anachronism. And, to be honest, I can't imagine the police with their stretched resources pulling over anyone who's using one sensibly.

Electric scooters in particular are great and, if you haven't tried one, you should. Florent Crivello, one of Uber's product managers, explains why they're not just fun, but actually valuable:

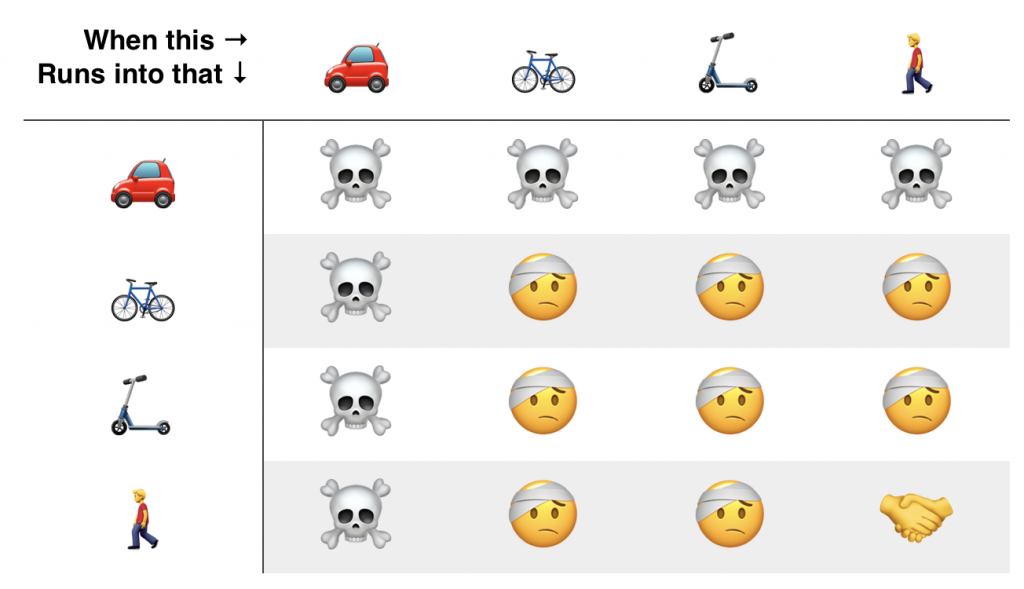

You might be wondering about the third one of these, as I was. Crivello includes this chart:

Of course, as he points out, you can prevent cars running into scooters, bikes, and pedestrians by building separate lanes for them, with a high kerb in between. Countries that have done this, like the Netherlands, have seen a sharp decline in fatalities and injuries.

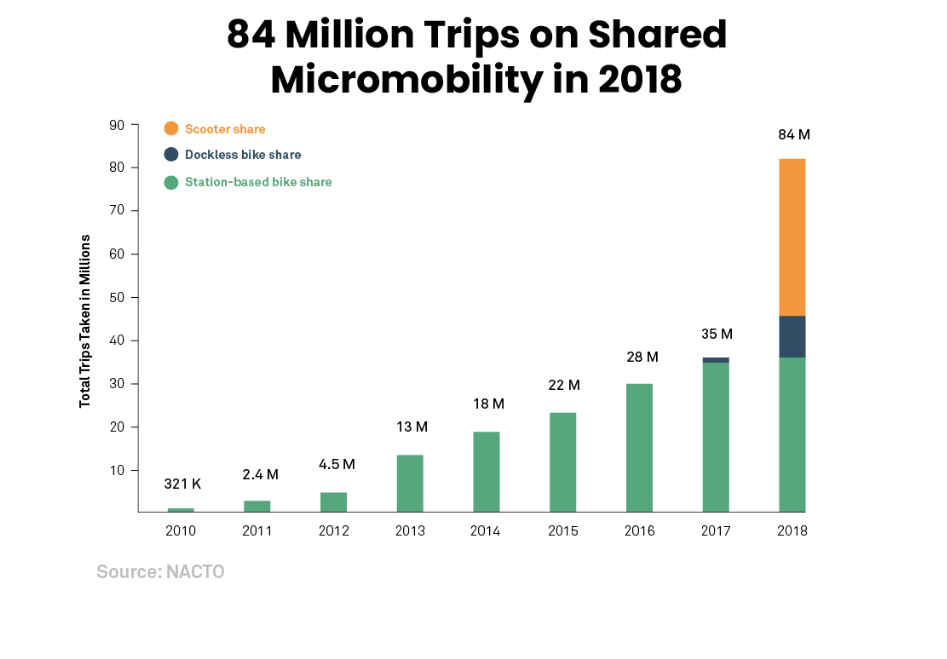

Despite the title, I'm focusing on electric scooters because of my enthusiasm for them and because of the huge growth since they became a thing about 18 months ago. Just look at this chart that Megan Rose Dickey includes in a recent TechCrunch article:

One of the biggest downsides to electric scooters at the moment, and one which threatens the whole idea of 'micromobility' is over-supply. As this photograph in an article by Alan Taylor for The Atlantic shows, this can quickly get out-of-hand when VC-backed companies are involved:

This can scare cities, who don't know how to deal with these kinds of potential consequences. That's why it's refreshing to see Charlotte in North Carolina lead the way by partnering with Passport, a transportation logistics company. As John R. Quain reports for Digital Trends:

“When e-scooters first came to town,” said Charlotte’s city manager Marcus Jones, “it left our shared bike program in the dust.”

[...]

By tracking scooter rentals and coordinating it with other information about public transit routes, congestion, and parking information, Passport can report on where scooters and bikes tend to be idle, where they get the most use, and how they might be deployed to serve more people. Furthermore, rather than railing against escooters, such information can help a city encourage proper use and behavior.

John R. Quain

I'm really quite excited about e-scooters, and can't wait until I can buy and use one legally in the UK!

Also check out: