- We should accept the premise that people will not run their own servers by designing systems that can distribute trust without having to distribute infrastructure. This means architecture that anticipates and accepts the inevitable outcome of relatively centralized client/server relationships, but uses cryptography (rather than infrastructure) to distribute trust. One of the surprising things to me about web3, despite being built on “crypto,” is how little cryptography seems to be involved!

- We should try to reduce the burden of building software. At this point, software projects require an enormous amount of human effort. Even relatively simple apps require a group of people to sit in front of a computer for eight hours a day, every day, forever. This wasn’t always the case, and there was a time when 50 people working on a software project wasn’t considered a “small team.” As long as software requires such concerted energy and so much highly specialized human focus, I think it will have the tendency to serve the interests of the people sitting in that room every day rather than what we may consider our broader goals. I think changing our relationship to technology will probably require making software easier to create, but in my lifetime I’ve seen the opposite come to pass. Unfortunately, I think distributed systems have a tendency to exacerbate this trend by making things more complicated and more difficult, not less complicated and less difficult.

NFTs as skeuomorphic baby-steps?

I came across this piece by Simon de la Rouviere via Jay Springett about how NFTs can’t die. Although I don’t have particularly strong opinions either way, I was quite drawn to Jay’s gloss that we’ll come to realise that “the ugly apes JPEGs were skeuomorphic baby-steps into this new era of immutable digital ledgers”.

On the one hand, knowing the provenance of things is useful. That’s what Vinay Gupta has been saying about Mattereum for years. On the other hand, the relentless focus of the web3 community on commerce is really off-putting.

Most databases are snapshots, but blockchains have history. When you see an NFT as having history associated with it, then you understand why a right-click-save only serves to add to its ongoing story. From the other lens, seeing an NFT as only a snapshot, you miss why much of this technology is important as a medium for information: not just in terms of art, collectibles, and new forms of finance.Source: NFTs Can’t Die | Simon de la RouviereThis era will be marked as the first skeuomorphic era of the medium. What was made, was simulacra of the real world. Objects in the real world don’t bring their history along with it, so why would we think otherwise? For objects in the real world, their history is kept in stories that disappear as fast as the flicker of the flame its told over. If you are lucky, it would be captured in notes/documents/pictures/songs, and in the art world, perhaps a full paper archive.

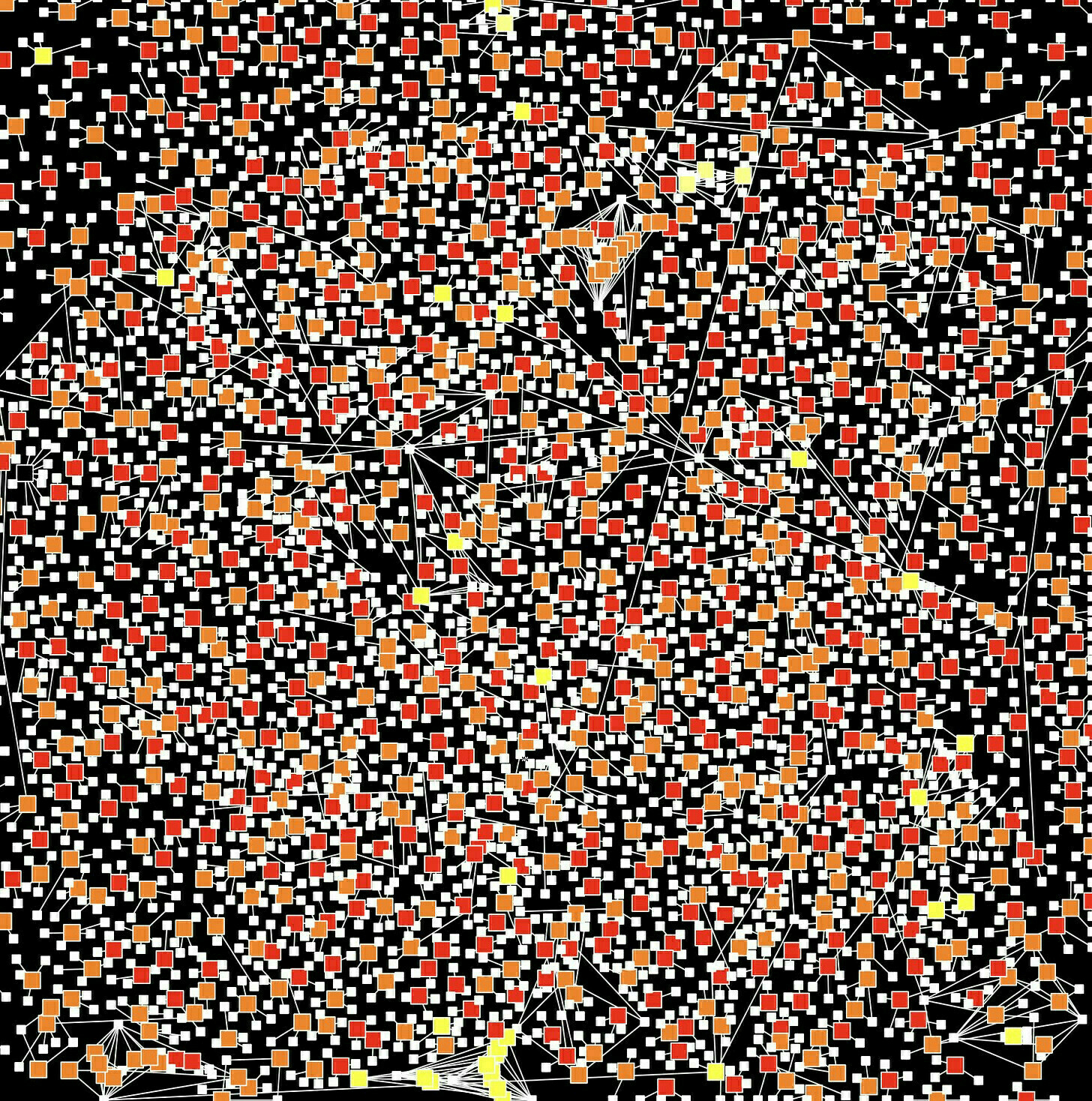

And so, those who made this era of NFTs, built them with the implicit assumption that each one’s history was understood. If need be, you’d be willing to navigate the immutable ledger that gave it meaning by literally looking at esoteric cryptographic incantations. A blockchain explorer full of signatures, transactions, headers, nodes, wallets, acronyms, merkle trees, and virtual machines.

On top of this, most of the terminology today still points to seeing it all as a market and a speculative game. And so, I understand why the rest was missed. The primary gallery for most people, was a marketplace. A cryptographic key to write with is called a wallet. Gas paid is used as ink to inscribe. All expression with this shared ledger is one of the reduction of humanity to prices. It’s thus understandable and regrettable that the way this was shown, wasn’t to show its history, but to proclaim it’s financialness as its prime feature. The blockchain after all only exists because people are willing to spend resources to be more certain about the future. It is birthed in moneyness. Alongside those who saw a record-keeping machine, it would attract the worst kind of people, those whose only meaning comes from prices. For this story to keep being told, its narratives have to change.

Songs are not meme stocks

Remember NFTs? This article in The Guardian will help remind you of the heady days of early 2022 when digital images of monkeys were apparently extremely valuable. That article ends with a question: “what will the next NFT be? When will it drop? How much money will normal people end up spending on it?”

Here’s one answer: owning a slice of your favourite song. Or perhaps a popular song. Or an up-and-coming song. It’s essentially applying capitalism at the very smallest level possible, and treating cultural artifacts as commodities.

The article below in WIRED discusses a platform which offers this as a service. It’s a terrible idea on many levels, not least because, as we’ve seen recently, AI-generated music is tearing fandoms apart. I’ll sit this one out, thanks.

Imagine a retirement portfolio stocked with Rihanna hits, or a college fund fueled by Taylor Swift’s 1989. In a post-GameStop, post-NFT-mania world, it sounds plausible enough. Wholesome, even.Source: The Next Meme Stock? Owning a Slice of Your Favorite Song | WIREDA new music royalties marketplace, Jkbx (pronounced “jukebox”), launched this month and plans to officially open for trading later this year. It has filed an application with the US Securities and Exchange Commission and is waiting for notice that the SEC has qualified its offerings. As long as that goes according to plan, Jkbx—god, why no vowels?—will allow fans to buy “royalty shares,” or fractionalized portions of royalties, fees, and other income associated with a particular song. Prices are within reach of regular people. One share of composition royalties for Beyoncé’s “Halo,” for example, is $28.61. You could also buy a slice of the song’s sound recording royalties for the same price.

[…]

Jkbx is debuting with some big-name slices, and is led by a guy with a good track record. “They are very sophisticated,” Round Hill Music founder and CEO Josh Gruss says. “The real deal.” Others agree. “We think they are going to be successful,” Hipgnosis Songs CEO and founder Merck Mercuriadis says.

Still, plenty of industry analysts and insiders view Jkbx, and the larger world of royalty trading, warily. “I think there are going to be very modest levels of return,” says Serona Elton, a music industry professor at the University of Miami.

“There is skepticism about how good of an alternative investment strategy something like this is,” musician and data analyst Chris Dalla Riva says.

“I don’t understand why people keep trying to spin this idea up,” adds producer and music tech researcher Yung Spielburg. “I just don’t get it.”

Do NFTs tend towards dystopia?

At the weekend I visited the Moco Museum with my wife in Amsterdam. It’s the first time I’ve seen an NFT art exhibition. It wasn’t… bad? But, as someone commented when I said as much on social media, the ownership model is kind of irrelevant. It’s the digital art that matters.

(the animation below is from a video I took of an appropriate Beeple artwork)

What I think we’re all starting to realise is that for everything to be on the blockchain, we would need to fundamentally change the nature of human interaction. And that change would be toward dystopia.

In this article, James Grimmelmann, who is a professor at Cornell Law School and Cornell Tech (where he directs the Cornell Tech Research Lab in Applied Law and Technology) explains just this.

Loosely speaking, there are three kinds of property you could use an NFT to try to control ownership of: physical things like houses, cars, or tungsten cubes; information like digital artworks; and intangible rights like corporate shares.Grimmelmann clarifies in a footnote that just because NFTs might work for art, doesn’t mean they’re appropriate for… well, anything else:By default, buying an NFT “of” one of these three things doesn’t give you possession of them. Getting an NFT representing a tungsten cube doesn’t magically move the cube to your house. It’s still somewhere else in the world. If you want NFTs to actually control ownership of anything besides themselves, you need the legal system to back them up and say that whoever holds the NFT actually owns the thing.

Right now, the legal system doesn’t work that way. Transfer of an NFT doesn’t give you any legal rights in the thing. That’s not how IP and property work. Lawyers who know IP and property law are in pretty strong agreement on this.

It’s possible to imagine systems that would tie legal ownership to possession of an NFT. But they’re (1) not what most current NFTs do, (2) technically ambitious to the point of absurdity, and (3) profoundly dystopian. To see why, suppose we had a system that made the NFT on a blockchain legally authoritative for ownership of a copyright, or of an original object, etc. There would still be the enforcement problem of getting everyone to respect the owner’s rights.

A lot of the current hype around NFTs consists of the belief that the rest of the world will follow the same rules as NFT art. But of course part of the point of art is that it doesn’t follow the same rules as the rest of the world.Source: I Do Not Think That NFT Means What You Think It Does | The Laboratorium

NFTs, financialisation, and crypto grifters

At over two hours long, I’m still only half-way through this video but I can already highly recommend it. There’s some technical language, as befits the nature of what’s discussed, but I really appreciate it going right back to the financial crisis to explain what’s going on.

[embed]www.youtube.com/watch

Source: The Problem With NFTs | YouTube

Signal's CEO on 'web3'

My first response to most new technological things is usually “cool, I wonder how I/we could use that?” With so-called ‘web3’, though, I’ve kind of thought it was bullshit.

This post by Moxie Marlinspike, CEO of Signal, goes a step forward and includes opinions by someone who actually knows what they’re talking about.

I’m not sure what I think about the bit quoted below about not distributing infrastructure? In Marxist terms, it seems like not distributing or providing ownership of the means of production?

If we do want to change our relationship to technology, I think we’d have to do it intentionally. My basic thoughts are roughly:Source: Moxie Marlinspike >> Blog >> My first impressions of web3

Update: Moxie Marlinspike has announced he’s stepping down as Signal CEO.

Invisible sculptures are the logical conclusion of NFTs

Speechless.

According to Garau, the sculpture doesn't not exist per se, rather it exists in a vacuum, Newsweek reports. "The vacuum is nothing more than a space full of energy," Garau explained. "And even if we empty it and there is nothing left, according to the Heisenberg uncertainty principle, that 'nothing' has a weight. Therefore, it has energy that is condensed and transformed into particles, that is, into us."Source: Italian Artist Sells Invisible Sculpture for $18,000 | highsnobiety

Of all lies, art is the least untrue

The world doesn't particularly need my opinions on NFTs ('non-fungible tokens') as there's plenty of opinions to go round in other newsletters, podcasts, and blog posts.

After doing a bunch of reading, though, I think that the main use case for NFTs will be ticket sales. That is to say, when there is a limited supply of something with intrinsic value, and both the original buyer and seller want to ensure authenticity.

The rest is speculation and gambling, as far as I'm concerned, with a side serving of ecological destruction. I'm also a bit concerned about the enforcement of copyright everywhere on the web it might lead to...

Twitter's Dorsey auctions first ever tweet as digital memorabilia — "The post, sent from Dorsey’s account in March of 2006, received offers on Friday that went as high as $88,888.88 within minutes of the Twitter co-founder tweeting a link to the listing on ‘Valuables by Cent’ - a tweets marketplace."

NFTs, explained — “Non-fungible” more or less means that it’s unique and can’t be replaced with something else. For example, a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible. If you traded it for a different card, you’d have something completely different. You gave up a Squirtle, and got a 1909 T206 Honus Wagner, which StadiumTalk calls “the Mona Lisa of baseball cards.” (I’ll take their word for it.)"

NFTs are a dangerous trap — "The more time and passion that creators devote to chasing the NFT, the more time they’ll spend trying to create the appearance of scarcity and hustling people to believe that the tokens will go up in value. They’ll become promoters of digital tokens more than they are creators. Because that’s the only reason that someone is likely to buy one–like a stock, they hope it will go up in value. Unlike some stocks, it doesn’t pay dividends or come with any other rights. And unlike actual works of art, NFTs aren’t usually aesthetically beautiful on their own, they simply represent something that is."

Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining — "Results indicate that in 2018, each $1 of Bitcoin value created was responsible for $0.49 in health and climate damages in the US and $0.37 in China. The similar value in China relative to the US occurs despite the extremely large disparity between the value of a statistical life estimate for the US relative to that of China. Further, with each cryptocurrency, the rising electricity requirements to produce a single coin can lead to an almost inevitable cliff of negative net social benefits, absent perpetual price increases."

HERE IS THE ARTICLE YOU CAN SEND TO PEOPLE WHEN THEY SAY “BUT THE ENVIRONMENTAL ISSUES WITH CRYPTOART WILL BE SOLVED SOON, RIGHT?” — "Much like the world of blue chip, some NFTs may be bought and sold simply as artworks, intended for personal collections and acquired for aesthetic, conceptual, or personal reasons. However, every single one is made from the outset to be liquidated- an asset first, artwork second. They are images attached to dollar figures, not the other way around."

Quotation-as-title by Gustave Flaubert. Image of Nyan Cat, a 2011 meme, which sold as an NFT for ~$600,000 recently.

One should always be a little improbable

🍲 Introducing ‘Food Grammar,’ the Unspoken Rules of Every Cuisine — "Grammars can even impose what is considered a food and what isn’t: Horse and rabbit are food for the French but not for the English; insects are food in Mexico but not in Spain. Moreover, just as “Hey, man!” is a friendly greeting for a buddy but maybe not for your boss, foods may not be suitable in all grammatical contexts. “A Frenchman would think it odd to drink white coffee with dinner and an Italian probably would resent being served spaghetti for breakfast,” writes Claude Fischler in “Food, Self and Identity.” By the same token, rice is appropriate for breakfast in Korea but not in Ireland."

The essence of this article is that food is a reflection of culture, and our views of other cultures can become ossified. A good read.

🌍 Scientists begin building highly accurate digital twin of our planet — "The digital twin of the Earth is intended to be an information system that develops and tests scenarios that show more sustainable development and thus better inform policies. "If you are planning a two-metre high dike in The Netherlands, for example, I can run through the data in my digital twin and check whether the dike will in all likelihood still protect against expected extreme events in 2050," says Peter Bauer, deputy director for Research at the European Centre for Medium-Range Weather Forecasts (ECMWF) and co-initiator of Destination Earth. The digital twin will also be used for strategic planning of fresh water and food supplies or wind farms and solar plants."

This is the kind of thing that simultaneously fills me with hope and fear. On the one hand, such a great idea; on the other, if we get the model wrong, it could make things worse...

🤑 Why an Animated Flying Cat With a Pop-Tart Body Sold for Almost $600,000 — "The sale was a new high point in a fast-growing market for ownership rights to digital art, ephemera and media called NFTs, or “nonfungible tokens.” The buyers are usually not acquiring copyrights, trademarks or even the sole ownership of whatever it is they purchase. They’re buying bragging rights and the knowledge that their copy is the “authentic” one."

I've got a blog post percolating in my mind at the moment about digital reserve currencies, NFTs and deepfakes. There's something here about an emerging hyper-capitalist dystopia, for sure.

Quotation-as-title by Oscar Wilde. Image by Tu Tram Pham.